sales tax permit tulsa ok

State of Oklahoma 45 Tulsa County 0367. Returns for small business Free automated sales tax filing for small businesses for up to 60 days.

Oklahoma Tax Commission Facebook

The permit is required because each time you sell any merchandise as a business you need to charge taxes.

. The Sales Tax Permit fee is 20 and it will take at least five days for your Oklahoma Sales Tax Permit to be processed. How It Works 888 837-1407. 888 837-1407.

Launch vehicles satellites and such related attached or used property may also be purchased free from sales and use tax. No credit card required. Order FAQ.

Order sales tax. If you have any questions concerning the validity of a document or a claimed exemption or need to verify sales tax and agricultural exemption permits- contact 4055213160. This permit will furnish a business with a unique Oklahoma sales tax number otherwise referred to as an Oklahoma.

Apply For A Sellers Permit In Oklahoma PepRetail Trade Retail Sales in Tulsa Creek County OK. You can register a new business and obtain your sales tax permit through the Oklahoma Tax Commissions Online Business Registration System a part of OkTAP the Oklahoma Taxpayer. If out of state vendors will be making sales at your event you must obtain a special event sales tax permit from the oklahoma tax commission and submit a copy of the permit to.

Sales Tax in Tulsa Inside the City limits of Tulsa the Sales tax and Use tax is 8517 which is allocated between three taxing jurisdictions. To have this process fast-tracked the Oklahoma. Sales tax permit oklahoma Licenses LLC Permits Tax IDseBay Selling eBay Selling in Tulsa.

It costs 20 to apply for an Oklahoma sales tax permit. In the state of Oklahoma it is formally referred to as a sales tax permit. Theres also a convenience fee of 395 for paying with a Visa Debit card and a convenience fee of 25 for paying with.

For more information and certification contact the Oklahoma Tax. Apply For A Sellers Permit In Oklahoma PepRetail Trade Retail Sales in Tulsa Creek County OK. We would like to show you a description here but the site wont allow us.

Building Permit and License Center Plans Library Trade Permit Center Self Service Portal Many permitting activities can be done online using the Self. You will collect the taxes for the eBay sold items and pay it to the state. The Permit Center has three areas.

You can register for your Oklahoma sales tax permit online at the Taxpayer Access. 888 837-1407.

Taxes Broken Arrow Ok Economic Development

Should I Charge Tax On My Next Mow

Federal Register Regulatory Implementation Of The Centers Doc Template Pdffiller

Elliott S Tulsa Oklahoma One Day Estate Sale Estatesalestulsa Com Estatesales Org

10 Steps To Becoming A Residential Contractor In Tulsa Oklahoma 1256 Movement

Taxes Broken Arrow Ok Economic Development

How To Use Otc Reports Resources Ppt Download

Irish Flub Food Cooking Tulsaworld Com

Oklahoma Permits And Licenses Oklahoma Liquor Licenses Oklahoma Beer Permits

Owasso Oklahoma Business And Sales Tax Rates

E Commerce And Sales Taxes What You Collect Depends On Where You Ship Oklahoma State University

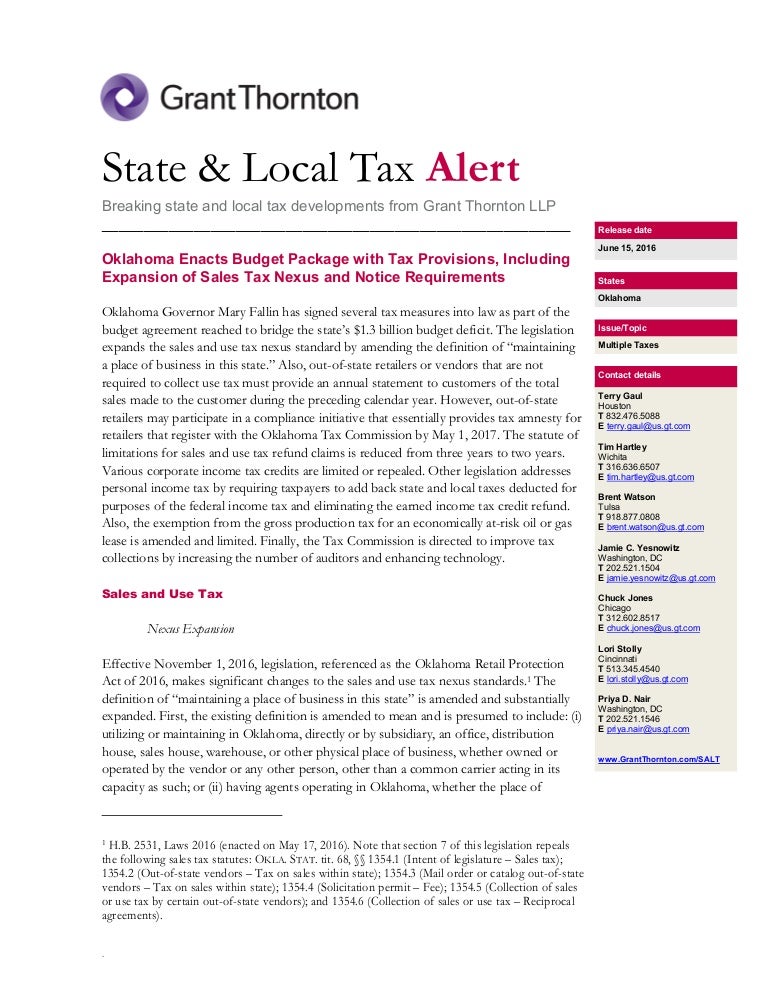

Oklahoma Enacts Budget Package With Tax Provisions Including Expansi